Hello friends, if you are reading this blog, that means you need a personal loan. But we all know that applying for a personal loan in a bank is just a harrasment. Sometimes we need small amount of money but nobody helps us at right time. Now everything is possible online, so you do not have to worry at all. There are many apps available in the play store, which provides personal loan instantly. Only that person can feel this situation when he needs money very badly and he gets a loan instantly. Well, all apps are not good. Some have some merits as well as demerits. You have to choose loan app accordingly to your need.

In this blog we will discuss about a loan app, which is known as “Buddy Loan App”. We have researched this Buddy loan App. After taking a personal loan from this app, we are now able to review it. You will know all merits and demerits of this app in this blog. Please read the post carefully.

In this blog you will know about, buddy loan app, how to apply loan, buddy loan app’s benefit, repayment periods of loan, etc.

Table of Contents

What is Buddy loan App?

Buddy loan is a personal loan app, which provides instant personal loan. Initially, this app was used only for personal loan, but now it also provides jobs, great offers, earn and redeem points by playing games. You can apply for loans online in the most seamless manner.

In the google play store, the Buddy loan app has more than 2 million downloads. You can get a personal loan in the range of Rs. !0,000 to Rs. 15,00,000 from buddy loan app.

Why should you use Buddy Loan App?

- This app is safe to use.

- It provides loans instantly.

- It also provides buisness loan, two-wheeler loan, car loan, marriage loan, travel loan, medical loan, education loan, home loan and gold loan.

- You can get Rs.10000 to Rs.1500000 depending upon your eligibility.

- Comparing to other loan apps, it has lower rate of interest i.e. 11.99% per annum.

- You get a wide range of repayment period. Minimum tenure is 6 months and maximum tenure is 5 years.

- You get loan with paperless document verification.

- Buddy loan is the India’s biggest loan aggregator.

Eligibility of Buddy Loan App

- You should be an Indian citizen. Buddy loan doesn’t provide loans to NRIs.

- Your minimum age should be 23 years and maximum age should be 57 years, but to get approved preferable age group is 24 years to 57 years.

- Buddy loan provides personal loan for both salaried and self-employed. For salaried person.

- To get loan approval, your salary requirement should meet the minimum specific criteria based on your city of resident.

Documents required for Buddy Loan

For applying personal loan from the Buddy loan app, you have to submit the documents for proof of your identity, residence, and income. All documents will be submitted and verified online. Below is the list of documents.

- Identity: Any one of the Passport / Driving License / Voters ID / PAN Card.

- Residence: Any one of the Utility bill / Passport. Utility bill should not be more than 3 months old.

- Income: Latest three months bank statements.

What is the maximum loan amount and repayment period?

The maximum loan amount that can be disbursed is Rs. 15 lakhs, but it purely depends on your income and cibil score. You can repay the loan from 6 months to 60 months.

How to apply Personal loan from Buddy loan App?

Without going bank frequently, you can take a personal loan sitting on your chair. Does not it sound cool? Yes! it is. Applying online is very easy. Bellow step-by-step process is given.

- Step1: At first download Buddy loan App fromm the google play store. You can visit the official website of Buddy loan also.

- Step 2: Fill in all your details and fill your required loan amount.

- Step 3: Submit your related documents online. Required documents are already disucced above.

- Step 4: Choose the lender from the dashboard panel. (Because Buddy loan app is only a loan aggregator.)

- Step 5: Submit your loan application.

Conclusion

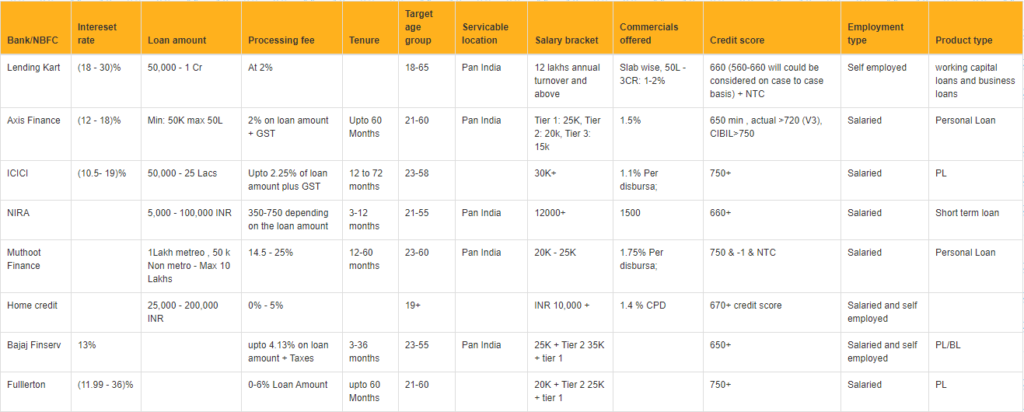

Nowadays everything is done online. It has made our life easier. You can also estimate your eligibility loan amount from the bellow table.

Hope you get to benefit from this blog. We have always one suggestion that, take the loan that much, which you can repay easily. Always repay your loan within the time period. Paying EMIs timely is a good practice. Never delay any repayment to avoid a bad cibil score.

If you want to know about low-interest home loans, read our blog on SBI home loan and HDFC home loan.

FAQS

What is the maximum amount of loan one can apply?

Maximum loan amount is Rs. 15 lakh. But that does not mean that your applying loan amount will get approved. It depends upon your income and cibil score.

Why should I choose Buddy loan app instead of any bank?

Buddy loan is a best loan agreegator. It can approve loan from different lending company. It will save your time and protects you from getting stress.

![[April 2022] Cred Cash Review | Instant cash loan without documents cred cash](https://odishaloan.com/wp-content/uploads/2021/12/Organic-Cat-Food-Blog-Banner-e1639580076972-218x150.jpg)

![[2022] How To Remove Credit Card From CRED? How to Remove credit card from CRED](https://odishaloan.com/wp-content/uploads/2022/04/Picture1-100x70.png)