2022 is coming and lives in the world have been changed a lot. People are getting aware of financing with the growth of technology. Now transactions are done online. The need for money has been increased. With this growing awareness, credit card has taken a special place in everybody’s wallet or phone (in case of digital credit card). All banks provide credit cards. Let’s ignore all these and come to the topic of “How to increase credit card limit HDFC in 2022”.

Table of Contents

How to increase credit card limit HDFC

HDFC offers different types of credit cards with different benefits. All the credit cards come along with a credit card limit. The HDFC credit card limit varies from user to user.

What is credit card limit?

With credit card you spend first, then you pay your bill within the pre-specified due date. Here credit card limit is the control to your spending. The credit card limit is the maximum allowed money you can spend.

Credit card helps us in emergency need of money. But the attractive offers provided by the banks make us use credit cards more for our utility bills, online transactions, shopping, and other daily needs. But if someone overspends the credits more than the capability to repay within the due date will be a worse situation. That’s why all credit cards come with a credit card limit.

But the credit card limit is not fixed and of course, you can enhance the credit card limit. But before knowing how, you should know on which factor the credit card limit is decided and the types of credit card limits. Understanding these facts, it will be easier for you to increase HDFC credit card limit.

On which factors HDFC credit card limit is decided

When HDFC issues new credit card, it comes with a predefined credit card limit. It may depend on user’s income and cibil score. But later it will consider your credit score, income debt ratio, and your other credit cards too. Accordingly your credit card limit will be enhanced every year.

- Credit score : Credit score is the parameter, which shows how trustworthy you are as a borrower. So before assigning you a credit card limit, HDFC bank will evaluate if you have a good credit score or not. If you have no credit history, your credit card limit will be lower.

- Income and debt ratio : Your income and debt should be balanced. If your in come is higher and you are in less or no debt, then chances of higher credit card limit is good.

- Other credit card: If you have credit card in other banks with higher limit, then your credit card limit may be increased.

Types of HDFC credit card limit

There are three types of credit card limit in HDFC credit card. They are 1. Total credit limit, 2. Available credit limit, 3. Cash limit.

The credit card limit which is given is known as total credit limit. Let’s you have total credit limit of Rs.75000. You spend Rs.25000 on shoping. Then the remaining Rs. 50000 is your available credit limit. If you pay monthly EMI of Rs.5000 next month, then on the next month your available credit limit will be Rs. 55000.

Coming to cash limit, HDFC offers some cash limit for emergency use. But it is subjected to withdrawal charge and fee. It should used only in emergency situation.

Check HDFC credit card limit

Login to the HDFC credit card net banking. Go to your dashboard and click on the credit card limit.

You can enquiry your HDFC credit card limit by calling HDFC customer care also.

How to increase credit card limit HDFC

Higher credit card limit helps you in many way. Anyone can face any emergency situation. If you have higher credit limit, you don’t have to ask anyone for help. If your exipenditure is high and you don’t want to handle multiple credit cards, then you should increase your credit card limit. Let’s know how.

We have discussed about many factors on which HDFC credit card limit depends. If all that factors satisfies, then HDFC bank will approach you to increase your credit limit. Other you can apply through net banking or by calling HDFC bank customer care.

How to increase hdfc credit card limit online

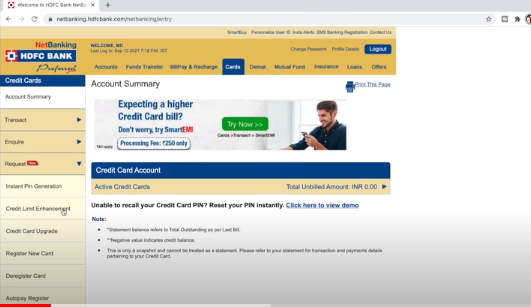

- Login to your HDFC net banking with your login credentials. Click on “Cards” section of menu.

- In the left side there is an option “Credit limit Enhancement”. Click on that.

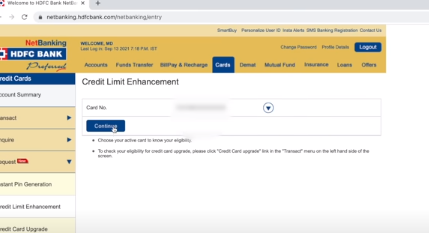

- Fill in your credit card number and click on continue.

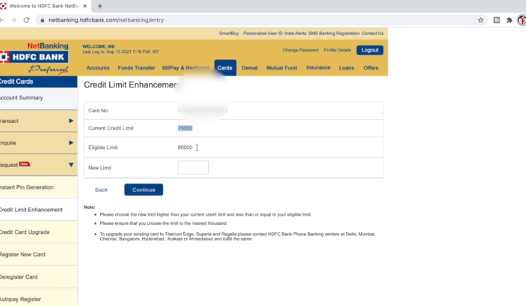

- In the next step, your both current HDFC credit limit will be shown. You can choose your new increased limit within eligible limit. You can also enter your whole eligible limit also. Then click on continue.

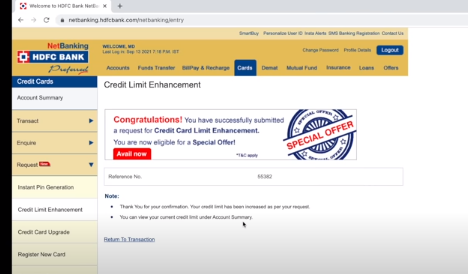

- Your request will be submitted. You will get congratulation message and some offers also.

- Within 24 hours your increased HDFC credit limit will be added to your card.

By calling HDFC customer care

- You can also increase your credit limit by calling HDFC customer care, which is 1800-258-3838.

- You have to request for increase hdfc credit limit and follow their instructions.

- You may have to visit your nearest HDFC branch with required documents.

In this way you can increase your HDFC credit limit.

FAQs

What is HDFC customer care number?

HDFC credit card customer care number for increasing credit limit is 1800-258-3838.

How to increase credit card limit HDFC?

You can increase HDFC credit limit by logging in Net banking or by calling customer care.

![[2022] How To Remove Credit Card From CRED? How to Remove credit card from CRED](https://odishaloan.com/wp-content/uploads/2022/04/Picture1-218x150.png)

![[2022] Flipkart Axis Bank Credit Card | Cashback, Eligibility, Benefits & Charges Flipkart Axis bank credit card](https://odishaloan.com/wp-content/uploads/2022/01/Flipkart-Axis-bank-credit-card-218x150.png)

![[2022] How To Remove Credit Card From CRED? How to Remove credit card from CRED](https://odishaloan.com/wp-content/uploads/2022/04/Picture1-100x70.png)